Also recommend evaluate new accounting pronouncements in the last decade to see if any updates needed in Chapter 5, “The Major Principles” section. Therefore, accounting principles play a crucial role in ensuring that accounting practices are uniform, scientific, and easily adaptable. In short, GAAP is designed to ensure a consistent presentation of financial statements, making it easier for people to read and comprehend the information contained in the statements. Want to understand why financial statements are crucial for your business?

- Companies that record their financial activities in currencies experiencing hyper-inflation will distort the true financial picture of the company.

- It would be easily possible to assemble a survey course combining topics from this book and the second offering (Principles of Managerial Accounting) to create a one-semester offering.

- The SEC mandates that publicly traded companies in the U.S. file GAAP-compliant financial statements regularly to maintain their public listing on stock exchanges.

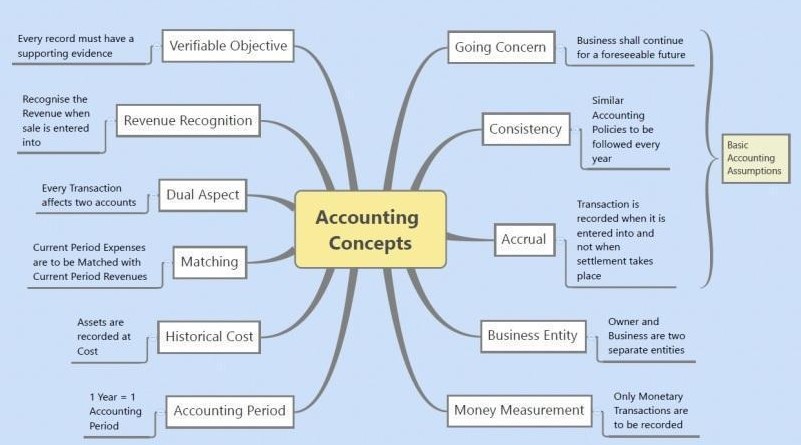

- The consistency principle encourages uniformity in accounting methods from one period to the next.

- Without GAAP, investors might be more reluctant to trust the information presented to them by public companies.

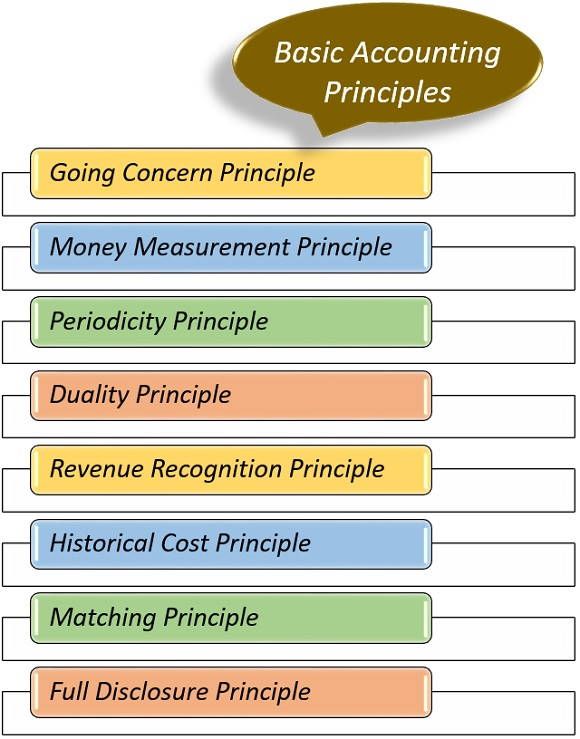

List of 10 Basic Accounting Principles

The rules for the measurement and recording of financial transactions are also less detailed compared to the full set of SFRS. “Financial Accounting” by Robert Libby, Patricia Libby, and Frank Hodge. A comprehensive book that covers the basics of financial accounting with a focus on GAAP principles, making it suitable for students and new accounting professionals. The four basic principles of GAAP include the Revenue Recognition Principle, Matching Principle, Full Disclosure Principle, and Cost Principle. These foundational principles guide preparing and presenting financial statements, ensuring they are accurate and consistent. The Principle of Permanence of Methods is a fundamental aspect of GAAP that ensures the reliability and comparability of financial statements.

What Are the Basic Principles of Accounting?

For example, if a company purchases a vehicle, the cost of the vehicle is spread over its estimated useful life rather than being fully expensed in the year of purchase. The consistent application of FIFO allows for a 5 principles of accounting meaningful year-over-year comparison of the cost of goods sold and inventory costs. It aids in understanding how inventory management and pricing strategies impact the company’s gross margin and overall profitability.

How does the Principle of Regularity function under GAAP?

Having more chapters is a plus especially if your student struggle with the basic concepts. I wish that the chapters on merchandising and inventory were back-to-back. I will flip these when I use the book in my class to provide more continuity for these concepts. These principles are incorporated into a number of accounting frameworks, from which accounting standards govern the treatment and reporting of business transactions.

What are the five major GAAP principles?

The sincerity principle is essential because it builds trust among stakeholders, including investors, creditors, and regulators. In an economic environment where financial information guides critical decisions, the sincerity of reporting can significantly impact market perceptions and decisions. Consider an accountant tasked with preparing the financial statements of a tech company that has just signed a multi-year software development contract. Materiality also allows for a mid-size company to report the amounts on its financial statements to the nearest thousand dollars. The concept of materiality means an accounting principle can be ignored if the amount is insignificant.

Submit to get your retirement-readiness report.

While this is important, financial models focus more on cash flow and economic value, which is not significantly impacted by accounting principles (other than for the calculation of cash taxes). By applying these practices, businesses can maintain the highest standards of financial reporting and provide stakeholders with reliable and transparent information. By adhering to this principle, you provide a comprehensive and transparent picture of your company’s monetary health to stakeholders. This transparency builds trust and allows them to make informed decisions based on a complete understanding of your business. This principle ensures a more accurate portrayal of your company’s profitability by reflecting the costs incurred to generate the revenue reported during that period. The Principle of Periodicity mandates that financial activities be recorded and reported over specific, uniform intervals.

It guarantees that a company’s financial situation and performance are appropriately reflected in its financial statements at any given moment. Tuition rates and student-debt continue to rise so any chance I have to cut the cost for my students removes a barrier to their success. I am hesitant to use this specific text in my class because the overall appeal is uninviting as well the overwhelming amount of information included in the first few chapters. I plan to look at other options or incorporate pieces of free texts into my class even just as supplemental material.

Chapter 1 presents a broad overview of accounting which is common in financial accounting texts. As I mentioned previously, chapter 2 makes the assumption that students already grasp at this early stage what revenues and expenses are and the differences between cash and accrual accounting. This book is perhaps the most comprehensive text I have seen for financial accounting. For those who are familiar with Financial Accounting, the index and glossary are sufficiently detailed. The fact that the text is so comprehensive is both a positive and a negative. It is positive in the sense that it has essentially every topic that you may want to cover in an introductory course.

Federal endorsement of GAAP began with legislation like the Securities Act of 1933 and the Securities Exchange Act of 1934, laws enforced by the U.S. Today, the Financial Accounting Standards Board (FASB), an independent authority, continually monitors and updates GAAP. Integrity Network members typically work full time in their industry profession and review content for Accounting.com as a side project. All Integrity Network members are paid members of the Red Ventures Education Integrity Network.