Selling each additional copy of a software product costs little since the distribution is almost free, and no “raw materials” are required (just support costs, infrastructure/bandwidth, etc.). For example, software companies tend to have high operating leverage because most of their spending is upfront in product development. The operating margin in the base case is 50%, as calculated earlier, and the benefits of high DOL can be seen in the upside case. Since 10mm units of the product were sold at a $25.00 per unit price, revenue comes out to $250mm. A company with a high DOL coupled with a large amount of debt in its capital structure and cyclical sales could result in a disastrous outcome if the economy were to enter a recessionary environment.

- However, you could use this formula if you assume that the company’s Operating Expenses are its Fixed Costs and that its Cost of Goods Sold or Cost of Services are all Variable Costs.

- Managers need to monitor DOL to adjust the firm’s pricing structure towards higher sales volumes as a small decrease in sales can lead to a dramatic decrease in profits.

- On that note, the formula is thereby measuring the sensitivity of a company’s operating income based on the change in revenue (“top-line”).

- Investors can use the change in EBIT divided by the change in sales revenue to estimate what the value of DOL might be for different levels of sales.

Telecom Company Example

Much of the price of a restaurant meal is in the ingredients and labor, meaning they’ll have low operating leverage. During the 1990s, investors marveled at the nature of its software business. The company spent tens of millions of dollars to develop each of its digital delivery and storage software programs.

The Difference Between Degree of Operating Leverage and Degree of Combined Leverage

The variability of sales level (operating leverage) or due to fixed financing cost affects the level of EPS (financial leverage). For example, in a company with high DOL, a 10% increase in sales could lead to a more than 10% increase in EBIT, magnifying the impact on profitability. This leverage can be advantageous during periods of rising sales but poses higher risks during downturns. Operating leverage and financial leverage are two types of financial metrics that investors can use to analyze a company’s financial well-being. Financial leverage relates to the use of debt financing to fund a company’s operations.

Degree of Operating Leverage (DOL): What Is It, Calculation & Importance

Besides, they are related because earnings from operations can be boosted by financing; meanwhile, debt will eventually be paid back by those increased earnings. Once obtained, the way to interpret it is by finding out how many times EBIT will be higher or lower as sales will increase or decrease respectively. For example, for an operating leverage factor equal to 5, it means that if sales increase by 10%, EBIT will increase by 50%.

As a result, Walmart’s cost of goods sold (COGS) continues to rise as sales revenues rise. The bulk of this company’s cost structure is fixed and limited to upfront development and marketing costs. Whether it sells one copy or 10 million copies of its latest Windows software, Microsoft’s costs remain basically unchanged. So, once the company has sold enough copies to cover its fixed costs, every additional dollar of sales revenue drops into the bottom line. Return on equity, free cash flow (FCF) and price-to-earnings ratios are a few of the common methods used for gauging a company’s well-being and risk level for investors. One measure that doesn’t get enough attention, though, is operating leverage, which captures the relationship between a company’s fixed and variable costs.

So, in the case of an economic downturn, their earnings may plummet because of their high fixed costs and low sales. The DOL is calculated by dividing the contribution margin by the operating margin. For example, the DOL in Year 2 comes out 2.3x after dividing 22.5% (the change in operating income from Year 1 to Year 2) by 10.0% (the change in revenue from Year 1 to Year 2). Revenue and variable costs are both impacted by the change in units sold since all three metrics are correlated. If sales were to outperform expectations, the margin expansion (i.e., the increase in margins) would be minimal because the variable costs also would have increased (i.e. the consulting firm may have needed to hire more consultants). After calculating the leverage by applying the formula, if the result is equal to 1, then the operating leverage indicates that there are no fixed costs, and the total cost is variable in nature.

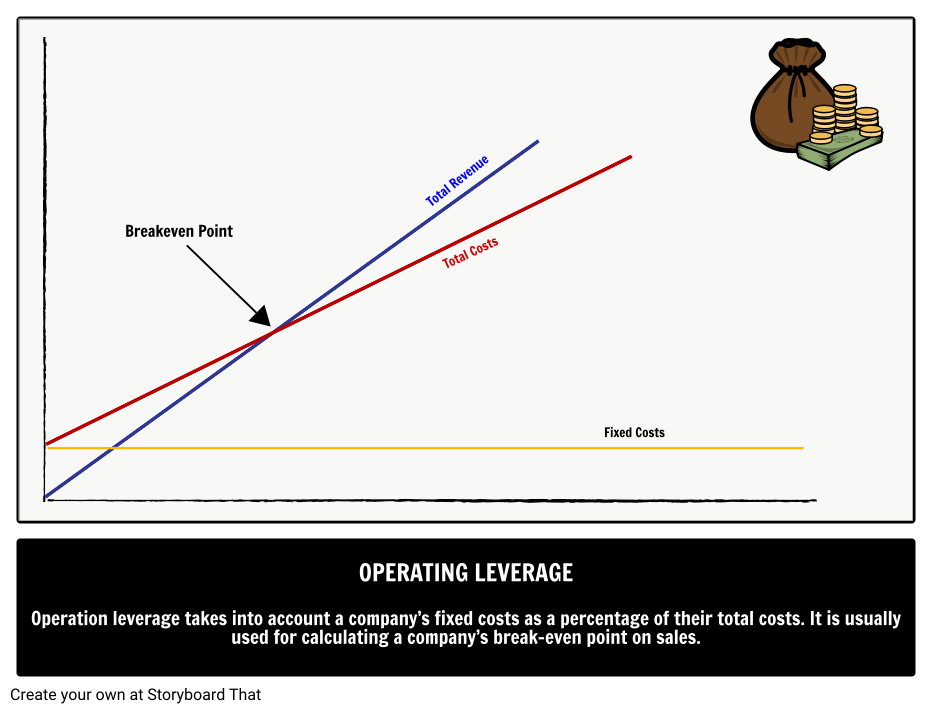

Conversely, operating leverage is lowest in companies that have a low proportion of fixed operating costs in relation to variable operating costs. Companies with high fixed costs tend to have high operating leverage, such as those with a great deal of research & development and marketing. With each dollar in sales earned beyond the break-even point, the company makes a profit.

However, companies rarely disclose an in-depth breakdown of their variable and fixed costs, which makes usage of this formula less feasible unless confidential internal company data is accessible. Fixed costs do not vary with the volume of sales, whereas variable costs vary directly with sales volume. The higher the degree of operating leverage, the greater the potential danger from forecasting risk, in which a relatively small error in forecasting sales can be magnified into large errors in cash flow projections.

However, you could use this formula if you assume that the company’s Operating Expenses are its Fixed Costs and that its Cost of Goods Sold or Cost of Services are all Variable Costs. We tend not to use this formula because it requires the Fixed Costs for the company, and most large/public companies do not disclose this number (see above). This formula is the easiest to use when you’re analyzing public companies with limited disclosures but independent trucking company services multiple years of data. But if a consulting firm bills clients for 1,000 hours vs. 100 hours, their expenses would be ~10x higher because they would need to pay their employees for 10x the hours. Microsoft could sell 50,000 copies of Windows or 10 million copies, and their expenses would be almost the same because it costs very little to “deliver” each copy. Get instant access to video lessons taught by experienced investment bankers.

Later on, the vast majority of expenses are going to be maintenance-related (i.e., replacements and minor updates) because the core infrastructure has already been set up. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. High leverage may be beneficial in boom periods because cash flow might be sufficient. As this discussion indicates, both operating and financial leverage (FL) are related to each other. Simultaneously, one should be conscious of the risks involved in increasing debt financing, including the risk of bankruptcy.

Building a cash flow statement from scratch using a company income statement and balance sheet is one of the most fundamental finance exercises commonly used to test interns and full-time professionals at elite level finance firms. You can calculate the percentage increase or decrease by dividing the second year’s number by the first year’s number and subtracting 1. For illustration, let’s say a software company has invested $10 million into development and marketing for its latest application program, which sells for $45 per copy. As said above, we can verify that a positive operating leverage ratio does not always mean that the company is growing. Actually, it can mean that the business is deteriorating or going through a bad economic cycle like the one from the 2nd quarter of 2020.