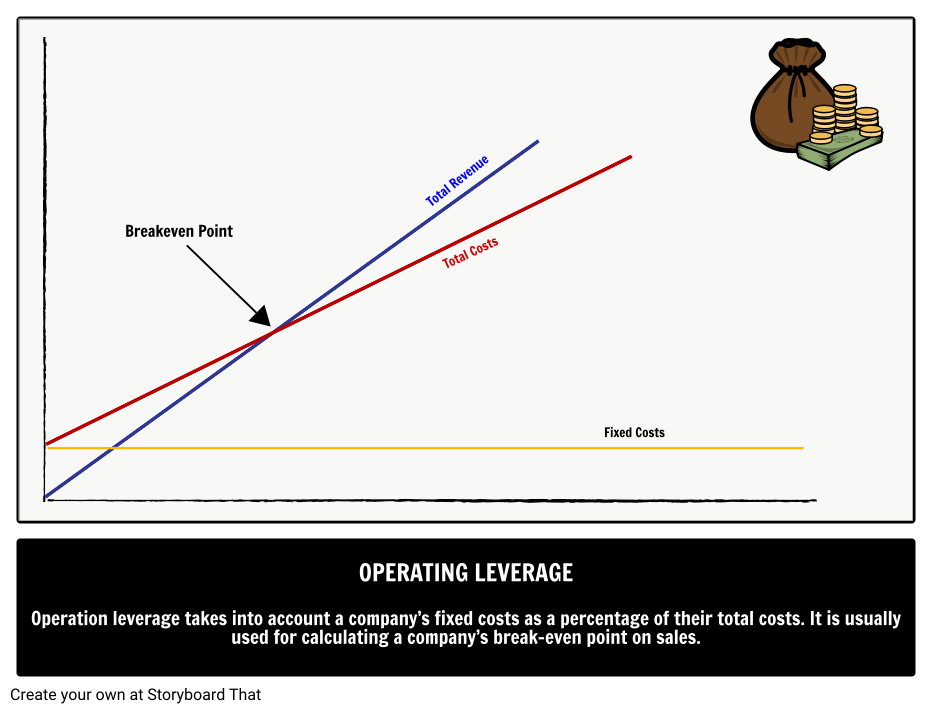

In contrast, companies with low operating leverage have cost structures comprised of comparatively more variable costs that are directly tied to production volume. The Operating Leverage measures the proportion of a company’s cost structure that consists of fixed costs rather than variable costs. Most of a company’s costs are fixed costs that recur each month, such as rent, regardless of sales volume. As long as a business earns a substantial profit on each sale and sustains adequate sales volume, fixed costs are covered, and profits are earned. DOL measures how sales changes affect operating income, while financial leverage measures the impact of debt on earnings per share.

What is your risk tolerance?

Yes, DOL can be used to compare the operational risk of companies within the same industry, helping investors identify firms with higher or lower financial risk profiles. So, while operating leverage is a good starting point for an analysis, it gives you an incomplete picture unless you also consider overall margins and industry dynamics when comparing companies. The airline industry, with “high operating leverage,” has performed terribly for most investors, while software / SaaS companies, which also have “high operating leverage,” have made many people wealthy. Also, the operating leverage metric is useless in some industries because it fluctuates too much or cannot be reasonably calculated based on public information. However, the risk from high operating leverage also depends on the company’s overall Operating Margins.

What is the approximate value of your cash savings and other investments?

This can be beneficial in periods of rising sales but risky when sales decline. A measure of this leverage effect is referred to as the degree of operating leverage (DOL), which shows the extent to which operating profits change as sales volume changes. Specifically, DOL is the percentage change in income (usually taken as earnings before interest and tax, or EBIT) divided by the percentage change in the level of sales output. The degree of operating leverage calculator is a tool that calculates a multiple that rates how much income can change as a consequence of a change in sales. In this article, we will learn more about what operating leverage is, its formula, and how to calculate the degree of operating leverage. Furthermore, from an investor’s point of view, we will discuss operating leverage vs. financial leverage and use a real example to analyze what the degree of operating leverage tells us.

Formula and Calculation of Degree of Operating Leverage

The shared characteristic of low DOL industries is that spending is tied to demand, and there are more potential cost-cutting opportunities. For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Adam Hayes, Ph.D., CFA, is a financial writer with 15+ years Wall Street experience as a derivatives trader. Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance. Adam received his master’s in economics from The New School for Social Research and his Ph.D. from the University of Wisconsin-Madison in sociology.

The Difference Between Degree of Operating Leverage and Degree of Combined Leverage

- Also, the DOL is important if you want to assess the effect of fixed costs and variable costs of the core operations of your business.

- Besides his extensive derivative trading expertise, Adam is an expert in economics and behavioral finance.

- This happens because firms with high degree of operating leverage (DOL) do not increase costs proportionally to their sales.

- In fact, operating leverage occurs when a firm has fixed costs that need to be met regardless of the change in sales volume.

- This means that it uses less fixed assets to support its core business while sustaining a lower gross margin.

This suggests that the company’s earnings before interest and taxes (EBIT) are highly sensitive to changes in sales. When sales increase, a company with high operating leverage can see significant boosts in operating income due to the fixed nature of its costs. Conversely, if sales decline, the company still needs to cover substantial fixed costs, which can significantly hurt profitability.

Ask Any Financial Question

If the operating leverage explains business risk, then FL explains financial risk. It should be noted that equity shareholders are entitled to the remainder of the operating profits of the firm after meeting all the prior obligations. In contrast, if funds are raised through equity shares, then the dividend to be paid is not a fixed charge. For example, if funds are raised through long-term debts such as bonds and debentures, these instruments carry fixed charges in the form of interest. By analyzing DOL, stakeholders can better anticipate the impacts of sales fluctuations on a company’s profitability.

If the sales volume is significant, it is beneficial to invest in securities bearing the fixed cost. Welcome to the fascinating world of the Degree of Operating Leverage (DOL)! If you’re eager to understand how changes in sales impact your operating income, you’re in the right place. This guide will walk you through the ins and outs of using the Degree of Operating Leverage Calculator, all while keeping things engaging and lighthearted.

After the collapse of dotcom technology market demand in 2000, Inktomi suffered the dark side of operating leverage. As sales took a nosedive, profits swung dramatically to a staggering $58 million loss in Q1 of 2001—plunging down from the $1 million profit the company had enjoyed in Q1 of 2000. Operating leverage can tell investors a lot about a company’s risk profile.

It is considered to be high when operating income increases significantly based on a change in sales. It is considered to be low when a change in sales has little impact– or a negative should i claim scholarships and other awards on my taxes impact– on operating income. Higher fixed costs lead to higher degrees of operating leverage; a higher degree of operating leverage creates added sensitivity to changes in revenue.

What is considered a good operating leverage depends highly on the industry. A higher operating leverage means the company has higher fixed costs, and a lower operating leverage means the company has higher variable costs. After its breakeven point, a company with higher operating leverage will have a larger increase to its operating income per dollar of sale. At the same time, a company’s prices, product mix and cost of inventory and raw materials are all subject to change.