For information pertaining to the registration status of 11 Financial, please contact the state securities regulators for those states in which 11 Financial maintains a registration filing. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy.

Core Concept

- If a business event occurred that is so insignificant that an investor or creditor wouldn’t care about it, the event need not be recorded.

- This facilitates better understanding, comparison, and decision-making.

- The SEC receives a large number of comments and complaints about the issue.

Some of the accounting principles in the Accounting Research Bulletins remain in effect today and are included in the Accounting Standards Codification. However, due to the complexities and sophistication of today’s global business activities and financing, GAAP has become more extensive and more detailed. If you were making a profit and loss statement for the first quarter of the year, for example, you wouldn’t cover transactions that occurred before or after the quarter.

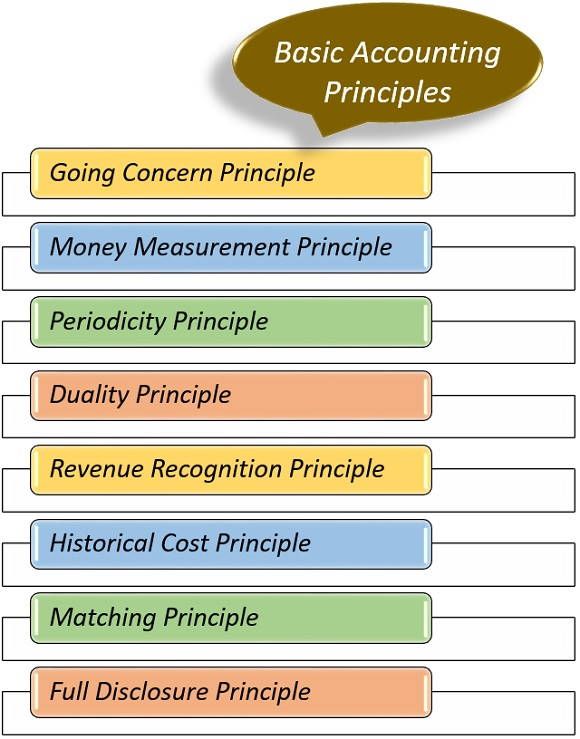

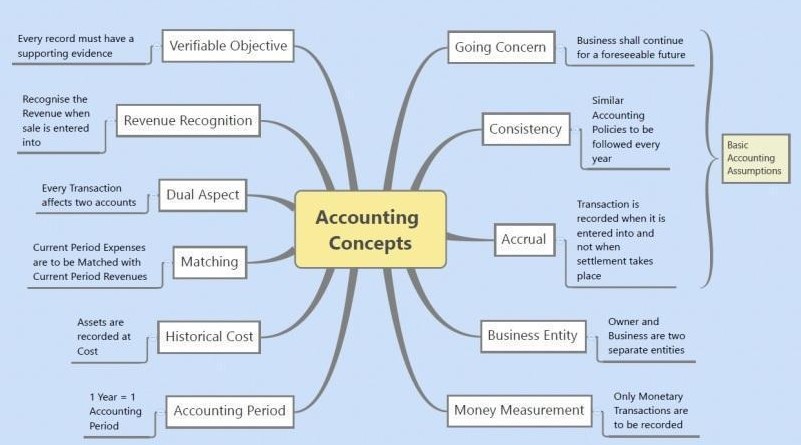

What are the Basic Accounting Principles?

By following these principles, businesses can ensure the accuracy, consistency, and transparency of their financial statements. By adhering to these principles, accountants and financial professionals uphold the highest financial reporting standards and contribute to various stakeholders’ trust and confidence in financial statements. An accounting guideline which allows the readers of financial statements to assume that the company will continue on long enough to carry out its objectives and commitments. In other words, the accountants believe that the company will not liquidate in the near future.

Generally Accepted Accounting Principles (GAAP)

There is less depth in delving into reasons for overhead variances as an example. Certainly, the emphasis at the principles level is primarily on basic application and calculation. However, the basis is appropriate for building 5 principles of accounting further complexity at the Intermediate and higher levels. Sometimes a book loses credibility if it appears to be out of date, so the book could be updated to use 20XX to have the appearance of being up to date.

GAAP is managed and published by the Financial Accounting Standards Board (FASB), which regularly updates the list of principles and standards. It is the U.S. equivalent of the International Financial Reporting Standards (IFRS). Though only regulated and publicly traded businesses are legally obligated to follow GAAP, some private companies also choose to meet the same standards in financial statements. In this post, I’ll share a very insightful view into the most essential accounting concepts and principles that’ll help you curate better financial statements over time. Since accounting principles differ around the world, investors should take caution when comparing the financial statements of companies from different countries.

Understanding GAAP

GAAP and IFRS principles ensure financial statement consistency, reliability, and comparability. IFRS (International Financial Reporting Standards) aims for similar goals but is used internationally. Both frameworks guide how financial transactions are recorded and reported but they differ in their approaches and standards. The main objective is to prevent the distortion of a company’s financial position.

There are too many chapters (provides options for instruction who emphasize certain chapters over others) but a concern is the way the text is constructed. I think the organization of this textbook is both logical and systematic. Each chapter unfolds in a coherent manner, with a clear progression of ideas and concepts.

Whether or not the two systems will ever truly integrate or converge remains to be seen, though efforts were made by the U.S. Securities and Exchange Commission from 2010 to 2012 to come up with an official plan for convergence. Accounting principles are the common guidelines and rules related to accounting transactions that are followed to prepare financial statements successfully. These principles are the founding guidelines for preparing and recording financials for proper analysis. These accounting principles are also known as Generally Accepted Accounting Principles or GAAP. Now that we have explored the five basic principles, let’s discuss how businesses can apply these in their reporting processes.

At Finance Strategists, we partner with financial experts to ensure the accuracy of our financial content. 11 Financial is a registered investment adviser located in Lufkin, Texas. 11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. The Principle of Continuity is vital in assessing the impairment of assets. Suppose there are indications that the continuity of the business is in jeopardy.