Posts

- Least expensive Universities in the uk to own international people

- Perform Now i need ID or proof of address?

- Ideas on how to unlock an united kingdom lbs sterling account while the a non-British resident

- How to work out when you’re a great United kingdom income tax citizen

- Opening a great multi-money membership

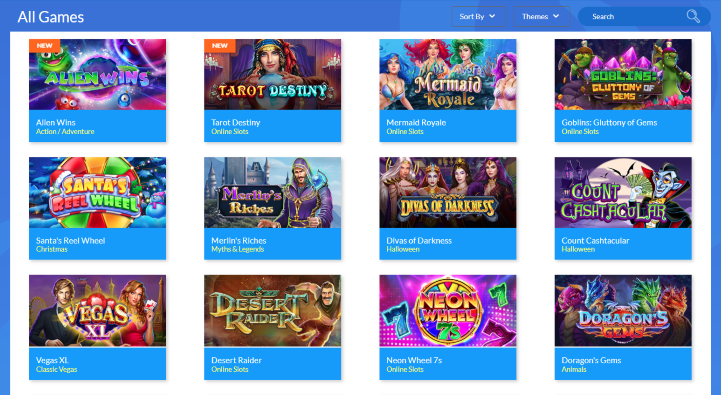

As the 2018, thousands of people have https://happy-gambler.com/elegance-casino/ obtained a keen eVisa on the internet, including through the Eu Payment Scheme. We’d in addition to browse through what’s needed, and some frequently asked questions we believe comes in convenient. When they’re informed, those people other schemes allows you to know if you’re-eligible. Here are the better cuatro Uk banks that you could prefer based on your position. But on the self-confident front side, whether or not you are an expert, pupil, or entrepreneur, you might discover a solution one perfectly fits yours otherwise business needs.

You can also be able to check in as the a temporary citizen when you are seeing away from abroad. If you have your own man health number (red-colored book) regarding the delivery of the boy, it will help to provide that it. If you do not features a permanent target you might nonetheless sign in playing with a short-term address and/or address of the GP surgery. Zero, its not necessary ID, an NHS amount or proof of address to join up. Many people need to join a functions close to in which it live.

Least expensive Universities in the uk to own international people

A fantastic mobile app enables you to keep an almost attention on the the fresh in the-comings and you can out-goings of all the your current membership. There is a qualifications calculator on the Lloyds website, to learn your chances of being accepted ahead of going through the genuine app process. As you’d expect of a respected bank, there’s an advanced cellular app you might obtain. To your software, you can instantly observe how far you may have on the membership and how much your’ve become paying.

Perform Now i need ID or proof of address?

I’ve written it total guide to United kingdom taxes to assist individuals with connections to the uk who happen to live abroad know their United kingdom income tax conditions. The best loved ones visa for your mate and kids all depends in your condition. When they meet the legislation to possess living in the uk, they’re able to in addition to apply for long lasting household, also known as ILR. To have families, bringing long lasting residence in britain form considering some extra anything. You should know how your application usually apply at your own companion, students, or other dependents. For many of us, taking long lasting residence in britain is actually one step to the becoming an united kingdom citizen.

This type of conditions are very important since the, as opposed to a proper visualize, a home card was refused. You should post your dated photocard license so you can DVLA after you get your the brand new license. You’ll be told the fresh target to use when you finish the application. For those who’re not an excellent United kingdom citizen, you’ll need the label file you employ so you can sign in in order to your own Uk Visas and you will Immigration (UKVI) membership. You’ll get a notice immediately after it’s already been recognized or whether or not here’s a necessary update on the software. Very always get into legitimate and precise guidance to stop one waits.

Typically, great britain means applicants to have lived in the world for a specific amount of many years, varying considering your current charge position. Individuals also needs to see code standards and you can solution an excellent ‘Lifestyle in britain’ try. Modifying your house reputation lower than Uk house regulations usually involves altering your way of life, including investing mostly time in the country.

Ideas on how to unlock an united kingdom lbs sterling account while the a non-British resident

Although not, starting a bank checking account in britain since the a non-citizen comes with its own set of obstacles. One of the major pressures low-people face is providing proof address. Traditional banking companies keep up with the discretion to help you refute account opening, so knowing the fundamentals of your own United kingdom bank system is extremely important. One method to overcome that it difficulty is via getting a bank report of various other bank because the target confirmation.

The new drawback is you often need to have a large number of pounds protected or spent to the financial, and you might must see minimum money requirements also. Owners normally spend British income tax on the all of their money, when it’s from the Uk or overseas. However, there are unique laws and regulations to own Uk residents whose long lasting house (‘domicile’) try overseas. Their United kingdom residence position has an effect on whether or not you pay taxation in the united kingdom on the foreign earnings. If you’ve immigrated for the Uk, or you’lso are a global citizen that have ties to the British, your own tax problem may not be clear-cut. Knowledge British tax residence legislation is very important for choosing when and you can the way you owe taxation and wealth thought moving forward.

How to work out when you’re a great United kingdom income tax citizen

But, as with every one thing tax-related, it will rating more complex than simply one. Because the April sixth 2015 expats and you will non-owners promoting a United kingdom assets owe investment development tax to the one growth made. Yes, long lasting house status, or ILR, provides you with the legal right to are now living in great britain.

Citizen Evil the most well-known playing companies with over 25 game put out since the 1996. Truth be told, notwithstanding a quick and you may sagging approach to the main cause thing, the new team is even one of the most successful video game adaptations for movie and television. Come across Setting We-90 while you are a legal long lasting citizen otherwise Form I-751 otherwise Setting We-829 when you are a great conditional permanent resident. You might have to shell out submitting fees to own a green Credit restoration or substitute for. Don’t allow the intricacies of one’s Statutory House Try overwhelm your. Which have Titan Wide range Around the world, know that you have got somebody dedicated to letting you browse your tax residency with ease.

Opening a great multi-money membership

The new remittance foundation from income tax is actually a new number of laws and regulations under the United kingdom income tax system one to pertains to ‘non-domiciled’ citizens. Under United kingdom abode regulations, someone can decide as taxed to the a remittance foundation, definition it pay Uk tax simply on the foreign money otherwise gains they bring to the uk. Less than United kingdom house legislation, if you’re a citizen, you’re normally susceptible to taxation on your own international money and progress. Because of this income and you can funding gains away from beyond your Uk are often nonexempt right here, whether or not your offer the money for the country.

His guidance gave me all the details and you can approach for my personal 2nd action. He informed I try myself but caused it to be obvious he may assist then basically expected they – and as exact and obvious concerning the price of using his features for another step. If you want assistance with the United kingdom taxation standards, if regarding possessions, or other assets, you will want to look for qualified advice of a dependable Uk tax specialist. Specifically, it must be indexed that if you is a non-citizen landlord you are required to file a good British taxation go back. Wrongly managing taxation household status is one of the most well-known taxation mistakes created by United kingdom expats. Income occurring in britain remains nonexempt even when you become a low-resident.

If you can’t take control of your very own membership, you can people to your bank account who’ll exercise for your requirements – called a good ‘proxy’. Such as, you will need a proxy for many who’re also a child or you provides a handicap that means you can’t do it yourself. You can inquire someone you believe in order to set up the new account – such a friend or loved one. You’ll also need access to an email target and so the Home Office can also be deliver condition.