View where you stand year round, and prepare your tax intuit self employed login return with live expert help for peace of mind. Automate your income and expense tracking to maximize your deductions and simplify year-end filings. In this section, you give the IRS information about any vehicles for which you’re deducting expenses in Part II. The IRS uses the answers in this section when reviewing your vehicle deduction to see if it seems legitimate. So it’s important, for example, to be able to answer YES to the question about whether you have written documentation for your deduction. If you answer NO, don’t be surprised if the IRS asks you to justify the deduction.

- Or have a dedicated expert do your self-employment and investment taxes for you with TurboTax Live Full Service.

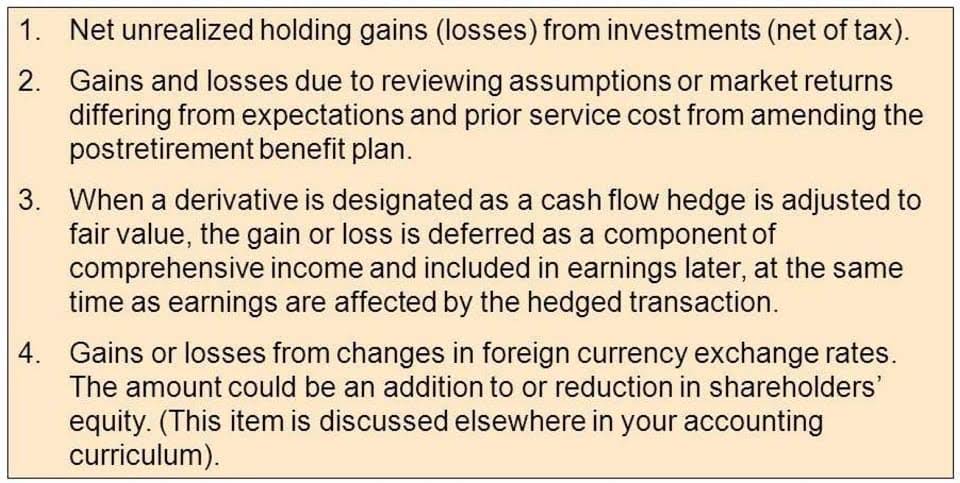

- This bonus “expensing” should not be confused with expensing under Code Section 179 which has entirely separate rules, see above.

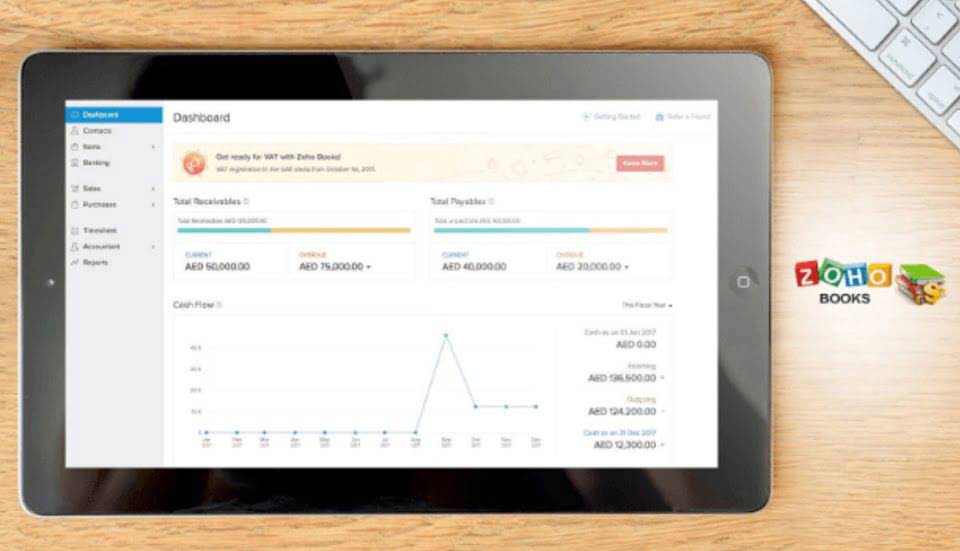

- It offers easier setup, an improved transaction management experience, along with added flexibility and productivity tools.

- Learn how QuickBooks features help self-employed business owners manage their bookkeeping and stay on top of their business finances.

- QuickBooks Self-Employed Blog also provides resources for sole traders to learn more about accounting and business.

TURBOTAX ONLINE/MOBILE OFFERS & PRICING

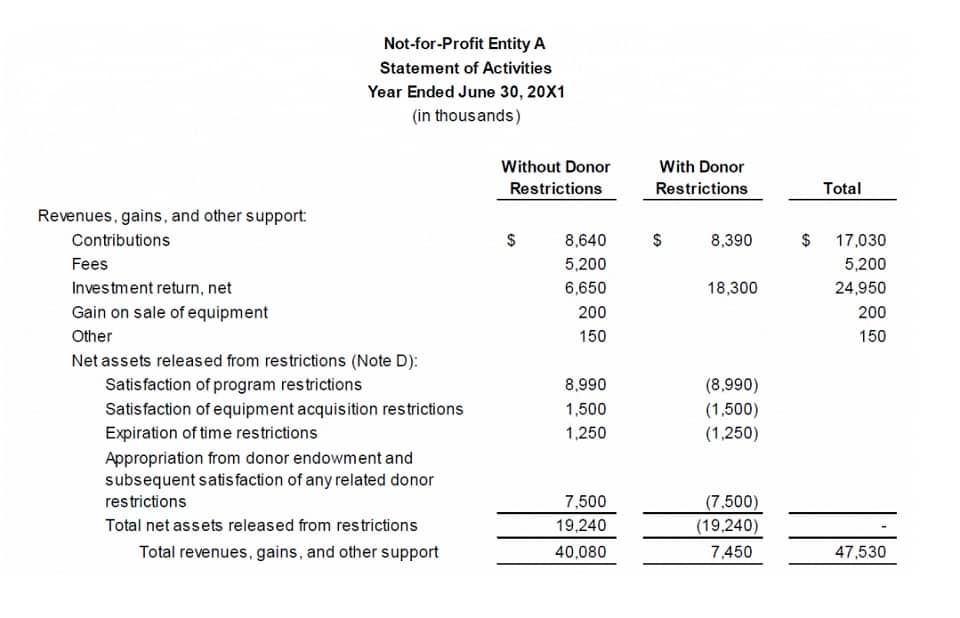

Total up these items contribution margin and subtract your cost of goods sold (which is calculated in Part III and explained below) to arrive at gross income. See how much you can save when a TurboTax expert does your taxes, start to finish. We offer free one-on-one audit guidance year-round from our experienced and knowledgeable tax staff. We’ll let you know what to expect and how to prepare in the unlikely event you receive an audit letter from the IRS. With 3,429,113 members and countless tax experts, we’ve got your question covered.

- Stability, investing in yourself, and running your business takes a combination of apps, knowledge, and grit.

- Security Certification of the TurboTax Online application has been performed by C-Level Security.

- Planning for cash flow problems can empower you to cushion—or even avoid—financial blows to your business.

- Create professional invoices for free and get paid twice as fast.

- Intuit helps put more money in consumers’ and small businesses’ pockets, saving them time by eliminating work, and ensuring they have confidence in every financial decision they make.

Your business wherever you are.

- If you have business expenses that don’t fit into the categories listed in Part II, report those expenses on the line for “Other Expenses” in Part V of Schedule C.

- Access your data on the go from your laptop, smartphone or tablet.

- Taxpayers can make an election to opt out of the new bonus depreciation rules and use 50% bonus first year depreciation per the prior rules for the first tax year ending after September 27, 2017.

- Your resource for helpful tax tips, tools, and articles on how to get the most out of being self‑employed.

- Get any-time access to balance sheets, cash flow statements, profit and loss statements, tax and GST information, and other customisable financial reports.

- QuickBooks offers free video tutorials for self-employed business owners to make using QuickBooks simple and straightforward.

Self-employment tax is an amount of money paid on self-employment net income to cover a person’s Medicare and Social Security tax. Whether our experts prepare your tax return or you do it yourself, guarantee our calculations are always 100% accurate, or we’ll pay any penalties. Uncover industry-specific deductions and get a final review by an expert before you file. Invite your accountant to access your books for seamless collaboration. Your data is protected with user-access levels which you can change and remove at any time. Learn how to use QuickBooks for self-employed sole traders with our free self-employed video tutorials.

Build the right plan for your business

Intuit helps put more money in consumers’ and small businesses’ pockets, saving them time by eliminating work, and ensuring they have confidence in every financial decision they make. Ideal for when you’re on the move, making it perfect for those who are self-employed. Now, you can capture receipts, sort expenses and send invoices from one app. QuickBooks seamlessly integrates with over 500 apps virtual accountant you already use to run your self-employed business.

Learn how to add and manage customers in QuickBooks Online using this detailed guide. Optimise your business to business inventory management with Erplain. Create and send professional-looking invoices in seconds.

By accessing and using this page you agree to the terms and conditions. Discover how integrated payroll apps can save you and your clients hours of admin. Attend a free live event to learn how QuickBooks can help you streamline your practice and more.

Benefits of accounting software for sole traders, freelancers and contractors

Your resource for helpful tax tips, tools, and articles on how to get the most out of being self‑employed. Free accounting tools and templates to help speed up and simplify workflows. See who’s paid and who hasn’t, and follow up with an automatic reminder. Security Certification of the TurboTax Online application has been performed by C-Level Security.

How long does it take to set up accounting software?

We also offer full audit representation for an additional fee with TurboTax Audit Defense. It is intended for one-person businesses looking to organize and grow their business. It offers easier setup, an improved transaction management experience, along with added flexibility and productivity tools.

Do more with QuickBooks Online

The 100% expensing is also available for certain productions, such as qualified film, television, and live staged performances, and certain fruit or nuts planted or grafted after September 27, 2017. We’ve broken down the form into sections, so you can see what the IRS expects from you and what records you’ll need at tax time. TurboTax Premium is a great solution if you feel comfortable doing your own taxes. If you want to do your own taxes with unlimited expert help as you go, choose TurboTax Live Assisted Premium. Or have a dedicated expert do your self-employment and investment taxes for you with TurboTax Live Full Service. Self-employment deduction from income can include expenses that are both ordinary and also necessary for your business.